What Does Kam Financial & Realty, Inc. Do?

What Does Kam Financial & Realty, Inc. Do?

Blog Article

Not known Factual Statements About Kam Financial & Realty, Inc.

Table of ContentsThe Definitive Guide for Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. - The FactsKam Financial & Realty, Inc. Can Be Fun For Everyone6 Simple Techniques For Kam Financial & Realty, Inc.Everything about Kam Financial & Realty, Inc.The Best Guide To Kam Financial & Realty, Inc.

A home mortgage is a car loan used to buy or maintain a home, story of land, or other actual estate. The borrower consents to pay the lending institution over time, generally in a collection of regular settlements split into principal and passion. The residential property then acts as security to safeguard the financing.Mortgage applications undertake a rigorous underwriting procedure before they get to the closing stage. Home loan types, such as standard or fixed-rate loans, differ based upon the consumer's demands. Home loans are car loans that are made use of to get homes and various other kinds of property. The residential or commercial property itself offers as collateral for the financing.

The price of a mortgage will rely on the kind of car loan, the term (such as three decades), and the rates of interest that the loan provider costs. Mortgage rates can differ widely depending upon the kind of item and the qualifications of the applicant. Zoe Hansen/ Investopedia People and businesses utilize home loans to acquire real estate without paying the whole purchase price upfront.

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking About

Most conventional home loans are fully amortized. Regular home loan terms are for 15 or 30 years.

A residential property buyer promises their home to their lender, which after that has an insurance claim on the property. This makes certain the lender's passion in the home should the customer default on their monetary responsibility. When it comes to foreclosure, the lending institution might evict the homeowners, offer the home, and use the cash from the sale to repay the home mortgage financial debt.

The lending institution will ask for proof that the debtor is capable of paying back the financing. (https://www.metooo.io/u/kamfnnclr1ty)., and proof of existing work. If the application is authorized, the loan provider will certainly offer the borrower a lending of up to a particular quantity and at a particular rate of interest price.

The 8-Minute Rule for Kam Financial & Realty, Inc.

Being pre-approved for a mortgage can give purchasers an edge in a tight housing market because sellers will understand that they have the cash to back up their offer. As soon as a customer and vendor settle on the regards to their bargain, they or their agents will certainly satisfy at what's called a closing.

The vendor will transfer ownership of the residential property to the buyer and receive the agreed-upon amount of money, and the purchaser will sign any type of staying home loan papers. There are hundreds of options on where you can obtain a home mortgage.

Our Kam Financial & Realty, Inc. Ideas

The conventional type of home loan is fixed-rate. A fixed-rate mortgage is additionally called a standard home mortgage.

The Definitive Guide to Kam Financial & Realty, Inc.

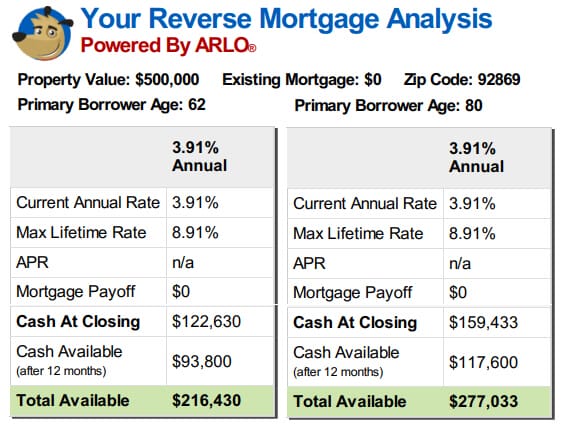

The entire car loan balance comes to be due when the customer passes away, relocates away completely, or markets the home. Factors are basically a cost that consumers pay up front to have a lower rate of interest rate over the life of their car loan.

Little Known Questions About Kam Financial & Realty, Inc..

How much you'll have to pay for a mortgage depends on the kind (such as repaired or adjustable), its term (such as 20 or three decades), any kind of discount factors paid, and the rate of interest at the time. california mortgage brokers. Rate of interest can differ from week to week and from lender to loan provider, so it pays to search

If you default and seize on your home mortgage, nonetheless, the financial institution might come to be the new owner of your home. The rate of a home is typically much better than the amount of cash that the majority of families conserve. Consequently, mortgages permit people and households to buy check these guys out a home by taking down just a fairly tiny deposit, such as 20% of the purchase rate, and getting a financing for the equilibrium.

Report this page